Please download the free Adobe Acrobat Reader to view these documents.

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

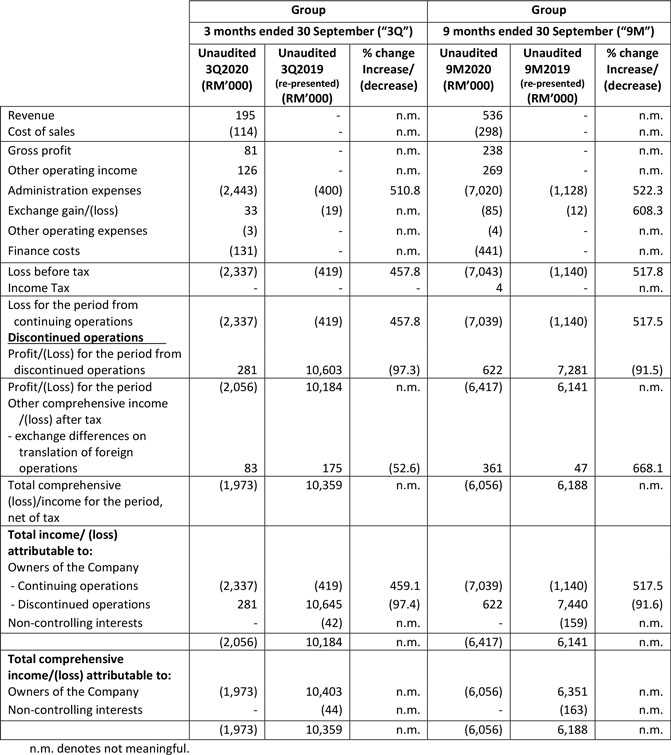

Review of Statement of Comprehensive Income

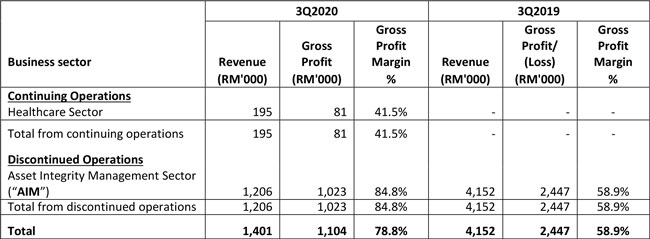

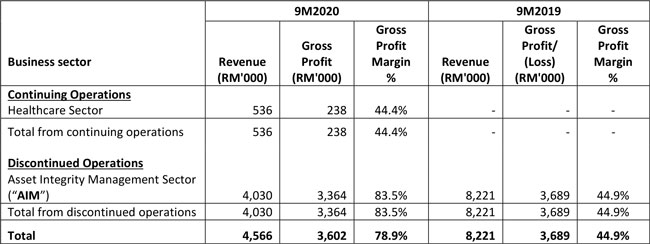

Breakdown by business segments

Three Months ended 30 September 2020

Nine Months ended 30 September 2020

Continuing Operations

Revenue

Revenue for the Healthcare Sector in 3Q2020 and 9M2020 were RM0.2 million and RM0.5 million respectively. No revenue was generated from the Healthcare Sector as the Group had acquired Lady Paradise Sdn. Bhd. which operates a postpartum centre in Petaling Jaya, Malaysia (“PJ Confinement Centre”), only during the fourth quarter of the financial year ended 31 December 2019 (“FY2019”). The revenue for the periods in review, mainly generated from the PJ Confinement Centre has been lower than planned despite operating at near capacity during the recent months due to refurbishment works in the centre that took place progressively.

Gross Profit

The Healthcare Sector’s gross profit for 3Q2020 and 9M2020 were RM81 thousand and RM238 thousand respectively. In addition, the Healthcare Sector’s gross profit margin for 3Q2020 and 9M2020 has been relatively stable at 41.5% and 44.4% respectively.

Other Operating Income

The Group’s other operating income for 3Q2020 and 9M2020 of RM126 thousand and RM269 thousand respectively were mainly from rental rebates from property leases and government subsidies for business restriction related to address the Covid-19 outbreak.

Administrative Expenses

Administrative expenses in 3Q2020 increased by 510.8% to RM2.4 million from RM0.4 million in 3Q2019 due mainly to an increase in(i) depreciation of right-of-use assets of RM1.3 million for the lease of a commercial property in Singapore for a planned postpartum centre; (ii) manpower cost of RM0.3 million; and (iii) office utilities and overheads of RM0.2 million.

Similarly, administrative expenses in 9M2020 increased by 522.3% to RM7.0 million from RM1.1 million in 9M2019 due mainly to expenses incurred for the Healthcare Sector and increased corporate expenses incurred for the fund-raising exercise completed on 14 January 2020 and the disposal of IEV Group Sdn. Bhd. which resulted in the Group’s exit from the AIM Sector. The increase in administrative expenses from the Healthcare Sector were mainly due to (i) depreciation of right-of-use assets of RM4.0 million arising from the lease of a commercial property in Singapore for a planned postpartum centre; (ii) increase in manpower cost of RM1.0 million; and (iii) office rental, utilities and overheads of RM0.3 million. Increased corporate expenses amounting to RM0.6 million were mainly for consultancy and legal expenses.

Exchange Loss/Gain

The Group recorded a marginal exchange gain of RM33 thousand in 3Q2020 compared to a marginal exchange loss of RM19 thousand in 3Q2019. For 9M2020, the Group recorded an exchange loss of RM85 thousand compared to an exchange loss of RM12 thousand in 9M2019. The exchange loss for 9M2020 was mainly due to the overall depreciation of the Malaysia Ringgit against the Singapore Dollar and a partial recovery of the Malaysia Ringgit during 3Q2020 resulted in the marginal exchange gain for 3Q2020.

Finance Costs

Finance costs for 3Q2020 and 9M2020 are RM131 thousand and RM441 thousand respectively, principally derived from the computation of interest on finance lease obligations, in the application of SFRS(I) 16 Leases for the lease of a commercial property in Singapore, which is planned for a postpartum centre.

Loss Before Tax

For reasons set out above, the Group recorded a 457.8% increase in loss before tax to RM2.3 million for 3Q2020 from RM0.4 million for 3Q2019. For 9M2020, the Group recorded a 517.8% increase in loss before tax to RM7.0 million from RM1.1 million in 9M2019.

Discontinued Operations

The Asset Integrity Management (“AIM”) Sector has been reclassified under discontinued operations, upon receiving shareholders’ approval in an extraordinary general meeting on 15 October 2020 to dispose of IEV Group Sdn. Bhd. and thus exiting from the AIM sector. The disposal is expected to be completed by the end of FY2020. The discontinued subsidiaries of the Renewable Energy and Mobile Natural Gas Sectors have been liquidated and disposed off respectively in 2018. The liquidation of PT Pabuaran KSO for the Exploration and Production Sector is nearing completion and is awaiting final business deregistration by the end of FY2020.

For 9M2020, a profit before tax of RM0.6 million from discontinued operations was recorded due mainly to a RM1.2 million write-back on impairment of receivables due from IEV (Malaysia) Sdn Bhd. Comparatively for 9M2019, the profit before tax of RM7.2 million was due mainly to a RM10.8 million reversal of provisions and liabilities in PT IEV Pabuaran KSO which was no longer required when the Company commenced a member’s voluntary liquidation, as announced on 13 September 2019.

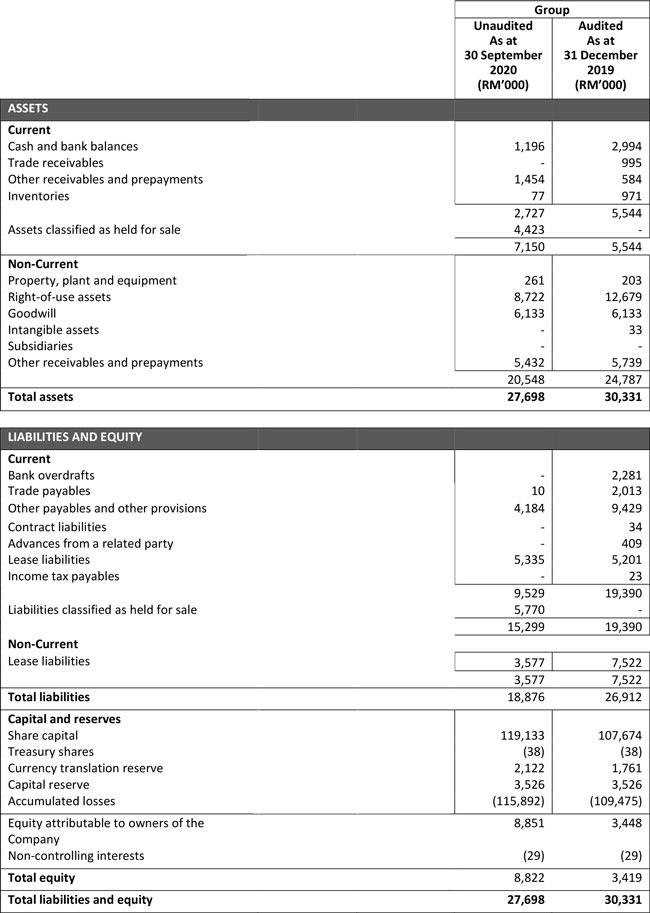

Review of Statement of Financial Position

Current Assets

Trade receivables as at 30 September 2020 was reduced to nil from RM1.0 million as at 31 December 2019 due to the reclassification of trade receivables from the AIM Sector as assets held for sale. The current portion of other receivables and prepayments increased by RM0.9 million to RM1.5 million as at 30 September 2020 from RM0.6 million as at 31 December 2019, due mainly to (i) deposit payment of RM0.5 million for interior design works in relation to a proposed postpartum centre in Petaling Jaya, Malaysia and (ii) GST receivable of RM0.5 million in relation to a Singapore postpartum centre undergoing renovation works. Inventory values reduced to RM77 thousand as at 30 September 2020 from RM1.0 million 31 December 2019 due mainly to: (i) RM145 thousand impairment and write-off of AIM Sector inventories and (ii) RM0.7 million transfer of AIM Sector inventories to assets held for sale. Assets held for sale of RM4.4 million as at 30 September 2020 represents the Current and Non-Current Assets of the AIM Sector that is planned to be disposed of.

Non-Current Assets

Net carrying value of property, plant and equipment (“PPE”) increased marginally to RM261 thousand as at 30 September 2020 from RM 203 thousand as at 31 December 2019. This was due to: (i) PPE acquisition of RM200 thousand relating to renovation improvements of a confinement centre in Petaling Jaya and office equipment; and (ii) RM250 thousand write-back of an impairment of PPE; which were partially offset by (i) depreciation charges of RM350 thousand depreciation charges and (ii) RM50 thousand transfer of AIM Sector PPE to assets held for sale. Right-of-use (“ROU”) assets decreased by RM4.0 million to RM8.7 million as at 30 September 2020 from RM12.7 million as at 31 December 2019 mainly due to depreciation charges of RM4.2 million during the 9M2020 period and partially offset by (i) the addition of an ROU asset of RM0.4 million for the lease of an office space in Singapore and (ii) a transfer of RM0.1 million ROU related to the AIM Sector to asset held for sale. Long-term receivables and prepayments as at 30 September 2020 reduced to RM5.4 million from RM5.7 million as at 31 December 2019 due mainly to the reclassification of GST Receivable to current other receivables and prepayments.

Capital and Reserves

Share capital of the Company and Group increased to RM119.1 million as at 30 September 2020 from RM107.7 million as at 31 December 2019 due to the allotment and issuance of 76,000,000 new ordinary shares to individual subscribers at an issue price of S$0.05 per ordinary share pursuant to a placement exercise.

Currency translation reserve as at 30 September 2020 increased to RM2.1 million from RM1.8 million as at 31 December 2019 due mainly to the appreciation of the Singapore Dollar against the Malaysian Ringgit during the period in review.

Accumulated losses for the Group increased by RM6.4 million to RM115.9 million as at 30 September 2020 from RM109.5 million accumulated losses as at 31 December 2019, mainly due to losses from continuing operations for 9M2020.

Non-Current Liabilities and Current Liabilities

Bank borrowings decreased to nil as at 30 September 2020 from RM2.3 million as at 31 December 2019, due mainly to progressive reductions in the overdraft amount and classification of a RM1.7 million overdraft balance as liabilities held for sale. Trade payables reduced to a minimal RM10 thousand as at 30 September 2020 from RM2.0 million as at 31 December 2019 due mainly to the classification of AIM Sector related trade liabilities as liabilities held for sale. Other payables and provisions as at 30 September 2020 decreased to RM4.2 million from RM9.4 million as at 31 December 2019 due mainly to (i) the settlement of payables of RM4.5 million related to the Singapore postpartum centre; and (ii) classification of RM1.0 million other payables related to the AIM Sector as liabilities held for sale. Advances from a related party reduced to nil as at 30 September 2020 from RM0.4 million as at 31 December 2019 as this amount which is related to the AIM Sector was classified as liabilities held for sale. Current and non-current lease liabilities reduced to RM8.9 million as at 30 September 2020 from RM12.7 million as at 31 December 2019 due mainly to (i) lease payments of RM3.1 million; (ii) classification of RM1.4 million as other payables pending negotiation of rental rebates related to commercial lease in Singapore and (iii) classification of AIMS Sector lease liabilities of RM0.1 million as liabilities held sale; which were partially offset by (i) additional lease commitments of RM0.4 million for the lease of an office space in Singapore and (ii) lease related interest expense of RM0.4 million.

The Group has negative working capital of RM8.4 million as at 30 September 2020 compared to a negative working capital of RM13.8 million as at 31 December 2019. The decrease in the negative working capital position was due to the allotment and issuance of 76,000,000 ordinary shares at an issue price of S$0.05 per ordinary share in the capital of the Company. Barring any unforeseen circumstances, the Group should be able to meet its working capital commitments for the next 12 months in view of (i) potential additional corporate fund-raising exercises and (ii) the Group’s estimated revenue from the Healthcare Sector.

Review of Statement of Cash Flows

For 3Q2020 the Group’s net cash used in operating activities was RM1.0 million. This was mainly due to: (i) an operating loss before working capital changes of RM1.5 million; and (ii) decrease in trade and other payables of RM0.6 million. These were partially offset by (i) decrease in trade and other receivables of RM0.9 million; and (ii) decrease in amount due from an associate of RM0.15 million. Investing activities for 3Q2020 was limited to the net acquisition of property, plant and equipment of RM0.1 million. Financing activities for 3Q2020 was RM0.1 million, mainly from rental discounts on commercial leases due to the Covid-19 viral outbreak.

For 9M2020, the Group recorded net cash used in operating activities of RM9.1 million. This was mainly due to: (i) an operating loss before working capital changes of RM3.6 million; (ii) decrease in payables related to renovation works of RM4.5 million; (iii) decrease in trade and other payables of RM1.4 million; (iv) increase in trade and other receivables of RM1.1 million and (v) decrease in contract costs of RM0.6 million. These were partially offset by (i) decrease in amount due from an associate of RM1.3 million; (ii) increase in contract liabilities of RM0.7 million; (iii) decrease in other receivables and prepayments of RM0.3 million; and (iv) decrease in inventories of RM0.1 million. Net cash used in investing activities of RM0.2 million for 9M2020 was for the acquisition of property, plant and equipment. Net cash generated from financing activities of RM8.5 million for 9M2020 was from (i) the net proceeds of RM11.5 million in the issuance of ordinary shares and (ii) rental discount of RM0.2 million on commercial lease due to the Covid-19 viral outbreak; which was partially offset by lease payments of RM3.1 million.

As a result of the above, the cash and bank balances was RM1.7 million as at 30 September 2020, compared to RM2.2 million as at 30 September 2019.

As the Group’s plan to dispose the Engineering Sector is expected to be completed by the end of fourth quarter 2020, the outlook for the Engineering Sector will no longer be featured in this section.

Healthcare Sector

The postpartum centre at SS2 Petaling Jaya, Malaysia (“SS2 Centre”), has been operating at near capacity despite the 3rd wave of Covid-19 pandemic in Malaysia with bookings having been secured until end 2020 and first half of 2021. The Group had, on 27 October 2020, announced the entry into a lease agreement for a second postpartum centre ("Mines2 Centre") in the Klang Valley region, Malaysia. The Mines2 centre is planned for 50 suites equipped with a nursery, incubation room, kitchen and other support services and is targeted to be operational by end of first quarter 2021.

With the continuing Covid-19 global pandemic, strict health and movement controls remain in place at IEV’s postpartum centre. Notwithstanding, IEV remains optimistic on the prospects for the Healthcare Sector especially with the heightened public awareness on the need for and emphasis on hygiene practices. Further, IEV has been diligently maintaining the quality of its postpartum care services, and at the same time, keeping a look out for opportunities within this sector.

Renovation works for the planned Singapore postpartum centre on Hendon Road has resumed but has since been delayed by several months due working restrictions and potential work variation. As such, sales and marketing campaigns are expected to commence in the first quarter of 2021 with an opening planned for in second quarter of 2021.

Concurrent with the efforts at developing the postpartum care business, the Group is also identifying and searching for complementary and new revenue streams in the aesthetics, wellness and physiology sectors as mentioned in the Company’s circular dated 3 October 2019. Further, the Company has plans on launching services related to alternative medicines (including, but not limited to traditional Chinese medicine) and physical therapy services such as chiropractic and physiotherapy services at its SS2 Centre. Further announcements will be made when there are material developments.